In the digital age, financial services are rapidly evolving, with SMS loan services in Germany at the forefront of this transformation. This article will explore the convenience, potential risks, and practical case studies of SMS loans to help readers assess whether they should opt for SMS loans in modern Germany.

Ⅰ.Overview of SMS Loans

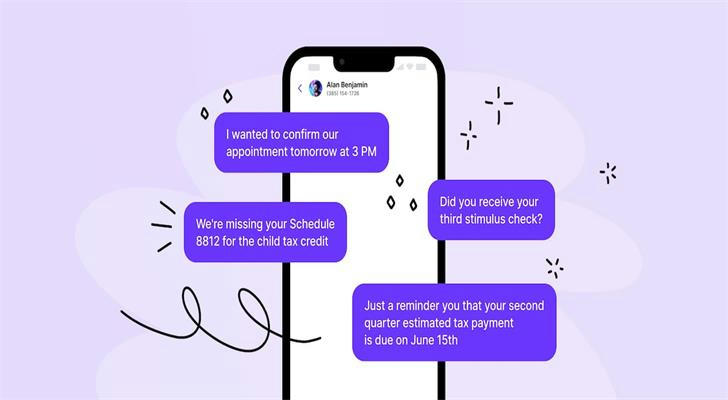

SMS loans, as an innovative financial service, allow users to quickly apply for loans by sending a text message. This service has gained attention in Germany's financial market for its immediacy and convenience.

Ⅱ.Advantages of SMS Loans

- Instant Response: Users do not need to visit a bank or fill out complex online forms.

- Fast Approval: Most services offer instant approval.

- Small Loans: Suitable for emergency fund turnover.

- No Credit Check Required: Ideal for users with poor credit history.

Ⅲ.The Process of SMS Loans

- Registration: Register with a financial institution, providing personal information and bank account details.

- Sending a Text Message: Send a text message in a specified format to a particular number.

- Approval and Disbursement: After the financial institution approves, the loan amount is transferred to the user's account.

- Repayment: Users must repay the loan according to the agreed terms and methods.

Ⅳ.Who is Suitable for SMS Loans

SMS loans are particularly suitable for the following groups:

- Urgent Fund Needs: Individuals who suddenly require funds to address emergencies, such as medical situations or car repairs, find the quick approval and disbursement of SMS loans an ideal choice.

- Small Business Owners: Small business owners often face cash flow issues, and SMS loans can serve as a quick way to obtain funds to keep their businesses running.

- Freelancers: Freelancers may have unstable incomes, and SMS loans can be a quick solution to address short-term financial issues.

- Those with Poor Credit History: For those who struggle to obtain loans from traditional banks due to poor credit history, SMS loans offer an alternative, albeit potentially at higher interest rates.

- Tech Enthusiasts: For tech enthusiasts who are accustomed to handling daily affairs via mobile phones, SMS loans offer a modern financial service that fits their lifestyle.

Ⅴ.Considerations for Users

- Interest Rates and Fees: Interest rates for SMS loans may be high, and users should read the contract terms carefully.

- Privacy Protection: Sending text messages containing personal information poses a risk of privacy leakage.

- Repayment Capacity: Users should assess their ability to repay.

- Legitimacy and Security: Before choosing an SMS loan service, verify the legitimacy and security of the service provider.

Ⅵ.Market Outlook for SMS Loans in Germany

The demand for SMS loan services in Germany is growing, especially for individuals and small businesses in need of quick fund turnover. It is expected that in the coming years, SMS loans will occupy a significant position in Germany's financial

market.

Relatedsearches

Ⅶ.Case Study

Michael, a freelancer who suddenly received an urgent project but needed to purchase some professional equipment first. Due to the tight schedule, he couldn't wait for the approval process of traditional bank loans. Therefore, Michael chose a financial technology company that offers SMS loan services. He sent a text message and received a loan of 500 euros in less than ten minutes. This fund helped him purchase the necessary equipment in time and successfully complete the project. Michael repaid on time after the project ended and praised the convenience of SMS loans.

As an emerging financial service, SMS loans provide a fast and convenient way for users in Germany to obtain loans. However, users should fully understand the associated costs, privacy protection, and repayment responsibilities. With the continuous advancement of financial technology, SMS loans are expected to provide timely financial support for more Germans, meeting their urgent funding needs. When choosing SMS loan services, users should act cautiously and select reputable financial institutions to ensure financial security. Through the case study, we can see the convenience that SMS loans bring to users in specific situations, but whether to choose this service still depends on individual circumstances and needs.

An international effort to dismantle a significant cryptocurrency exchange has taken a major step forward with the arrest of Aleksej Besciokov, an administrator linked to Garantex. Acting on a request from Washington, Indian authorities apprehended Besciokov in Kerala under allegations involving money laundering and sanctions violations. This move is part of a broader operation that also involved the collaboration of Germany and Finland in dismantling the online infrastructure of the Russian-based exchange. Since its inception in April 2019, Garantex has processed transactions exceeding $96 billion in cryptocurrency, making it a critical target for global law enforcement agencies combating illicit financial activities.

In a coordinated global initiative, multiple nations have joined forces to disrupt the operations of Garantex, a cryptocurrency platform accused of facilitating illegal financial transactions. The U.S. Justice Department announced last week that they had collaborated with Germany and Finland to dismantle the digital infrastructure supporting this platform. Central to these efforts was the arrest of Aleksej Besciokov, a dual Russian-Lithuanian national, who was detained in India at the behest of American authorities. Besciokov faces serious charges, including engaging in unlicensed money transmission and violating international sanctions. According to Indian officials, he was planning to leave the country when arrested, although the reasons behind his presence in India remain unclear.

The significance of this case lies not only in the scale of operations conducted by Garantex but also in its role as a hub for potentially unlawful financial dealings. Since 2019, the exchange has processed an estimated $96 billion worth of cryptocurrency transactions. This staggering figure underscores the challenge faced by regulators and law enforcement agencies worldwide in monitoring and controlling such platforms. Furthermore, Garantex itself became subject to U.S. sanctions back in 2022 due to suspicions regarding its involvement in illicit activities. The recent actions against it represent a substantial advancement in the ongoing battle against illicit finance facilitated through digital currencies.

Industry experts emphasize that while the dismantling of Garantex marks a significant achievement, vigilance must continue. A report by blockchain research company TRM Labs highlighted the potential for sanctioned entities like Garantex to re-emerge under different names or structures, thus evading restrictions. As such, the global community remains committed to maintaining stringent oversight over cryptocurrency exchanges to prevent their misuse for illegal purposes. With the extradition process for Besciokov anticipated to commence shortly, this case serves as a reminder of the complexities inherent in regulating the rapidly evolving landscape of digital finance.

International cooperation has proven vital in addressing the challenges posed by cryptocurrency exchanges suspected of engaging in illicit activities. Through collaborative efforts, authorities aim to establish more robust frameworks for monitoring and regulating these platforms. The arrest of Besciokov exemplifies how partnerships between countries can effectively curb the proliferation of illegal financial practices within the digital realm. Moving forward, stakeholders must remain proactive in identifying and mitigating emerging risks associated with cryptocurrencies, ensuring the integrity of the global financial system.

A proposed Minnesota House bill aims to offer school districts greater autonomy in allocating funds and opting out of recent state mandates. This legislation targets financially challenged districts by providing flexibility from 2023-24 through 2028-29, excluding federal funds. However, concerns have been raised regarding oversight and accountability, as well as the potential neglect of essential programs.

The bill has sparked debate among educators and policymakers over its implications for educational standards and resource management.

Promoting Financial Autonomy for Struggling Schools

This section outlines the primary goal of the bill: enhancing financial flexibility for schools facing budget constraints. The legislation would allow districts to redirect resources toward urgent needs rather than adhering strictly to predetermined allocations. Proponents argue that such freedom could alleviate fiscal pressures and enable more effective use of available funds.

Under this proposal, school districts would gain significant discretion in determining how best to utilize their budgets. For instance, they could allocate resources toward critical infrastructure repairs or support personnel without being constrained by rigid state regulations. Advocates highlight cases where current rules hinder practical solutions, such as using food service funds for roof repairs above cafeteria areas. Superintendent Dave Kerkvliet emphasized the challenge of funding specific needs within restrictive frameworks, noting the difficulty of hiring additional mental health staff with limited state-provided funds. Rep. Ben Bakeburg echoed these sentiments, underscoring the importance of empowering local leaders to address unique district requirements effectively.

Weighing the Benefits Against Potential Risks

While the bill promises increased flexibility, critics warn of possible adverse effects on educational consistency and program quality. Concerns center around diminished oversight and the potential abandonment of vital initiatives, particularly in professional development for paraprofessionals. These apprehensions reflect broader worries about maintaining high educational standards amidst expanded financial autonomy.

Critics, including Adosh Unni from the Minnesota Department of Education, caution against creating a fragmented system where each district independently decides which laws to follow. Such an approach could lead to inconsistent expectations and reduced accountability for state fund usage. William Schwandt, a special education paraprofessional, voiced opposition to the bill's potential impact on training opportunities for educational support staff. Meanwhile, alternative proposals, like those suggested by Rep. Cheryl Youakim, aim to provide targeted flexibility in specific areas such as nutrition and paraprofessional funding. Youakim’s efforts involve collaboration with stakeholders to craft balanced solutions that enhance district adaptability while preserving essential educational components. Despite ongoing discussions, the ultimate outcome of this legislative initiative remains uncertain, reflecting the complex interplay between fiscal freedom and educational integrity.